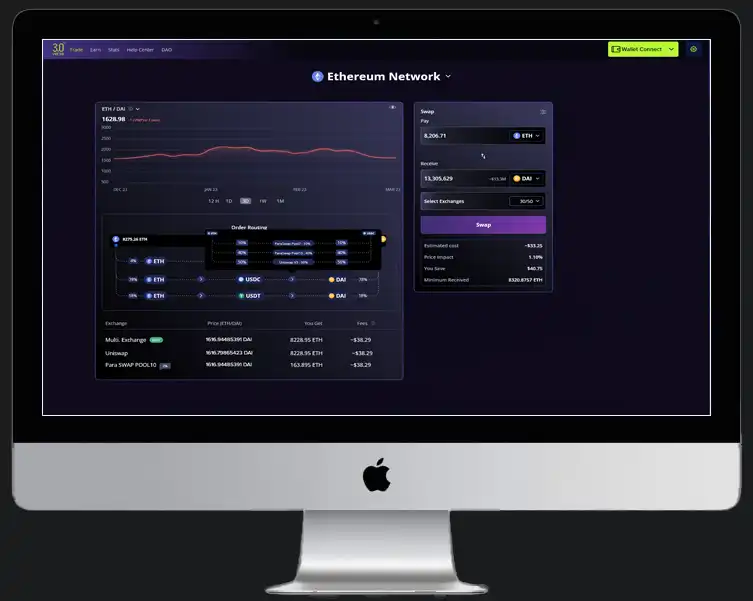

Multi SWAP

Multi-swap routing platform refers to a complex trading strategy that involves the simultaneous execution of multiple cryptocurrency swaps across different platforms or liquidity sources to achieve the most favorable exchange rates and optimize trading outcomes in the realm of swap trading crypto.

- Optimal Exchange Rates

- Market Impact Mitigation

- Algorithmic Precision

- Liquidity Optimization

- Performance Analysis

- Customizable Strategies

Multi-swap routing aims to exploit price discrepancies and liquidity variations across different cryptocurrency exchanges or platforms. The goal is to secure the best possible exchange rates while minimizing market impact and slippage in the world of swap platform crypto. Utilizing advanced algorithms, traders break down large trades into smaller transactions and distribute them strategically to exploit price discrepancies and liquidity variations. This approach optimizes trade execution and helps prevent significant market disruption. Risk management measures, such as position limits and stop-loss orders, are essential to mitigate potential losses due to market fluctuations. Traders must have a deep understanding of cryptocurrency markets, algorithmic execution, and regulatory considerations to implement this strategy effectively. Ultimately, multi-swap routing aims to enhance trading efficiency, achieve more favorable rates, and maximize returns for cryptocurrency traders and investors.

Algorithmic Execution

We provide advanced trading algorithms to automate the multi-swap routing process. These algorithms analyze real-time market data, order book depths, historical pricing trends, and liquidity levels to determine the optimal sequence and quantity of swaps required to achieve the desired outcome in the realm of swap exchange crypto.

Exchange and Platform Integration

We provide access to multiple cryptocurrency exchanges or liquidity providers in the context of top crypto swaps. Integration with these sources allows the algorithm to execute trades seamlessly across different platforms for cross chain swaps.

Liquidity Optimization

The algorithm seeks to optimize liquidity by selecting the exchanges or platforms with the best available rates and order book depths. This helps to minimize price slippage and ensure that the executed swaps closely match the expected rates in the realm of crypto swap.

Transaction Splitting

A key component of multi-swap routing involves breaking down the total trade volume into smaller transactions that can be executed across multiple exchanges or platforms in the world of crypto swap exchange. This approach helps prevent significant market impact due to large trades and ensures optimal execution.

Trade Execution Speed

Low-latency connections and high-speed trading infrastructure help in executing swaps rapidly and taking advantage of price disparities before they disappear in the realm of swap space crypto.

Diversification of Sources

Multi-swap routing involves utilizing a diverse range of exchanges or liquidity providers to mitigate the risk of relying on a single source for execution in the context of crypto swapping platforms.

Transparency and Reporting

We provide detailed reporting and transparency mechanisms for traders to review executed trades, track costs, and assess the performance of the multi-swap routing strategy in the world of online crypto swap.